1999 - Forecasts for the 21st Century

Forecast for the 21st century

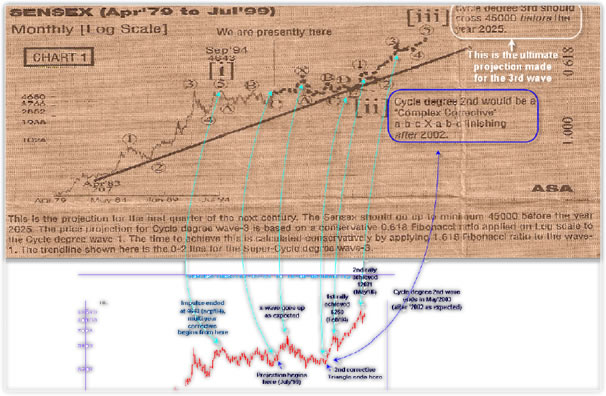

The Sensex will cross 5545 points in the ongoing Large-X wave. By the year 2025, the Sensex should reach 45,000 points - Vivek Patil Business Standard 26 JULY 1999 Ralph Nelson Elliott, the author of Wave Theory, always thought his theory to be "Nature's Law". He believed that like all other laws of nature, his theory should work on all time frames and for all situations in different stock markets. Glenn Neely was the one who further developed the theory and gave us some clear mathematical tools to arrive at precise conclusions about future market actions.

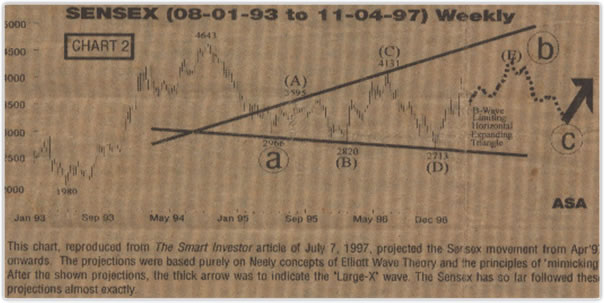

Based on these very concepts, this author had given certain projections for the Sensex, which were published in The Smart Investor dated July 7, 1997 (Chart 2) and articles thereafter. It surely is heartening to note that the Sensex has been behaving exactly according to these projections so far. The major facets of these projections were as follows:>

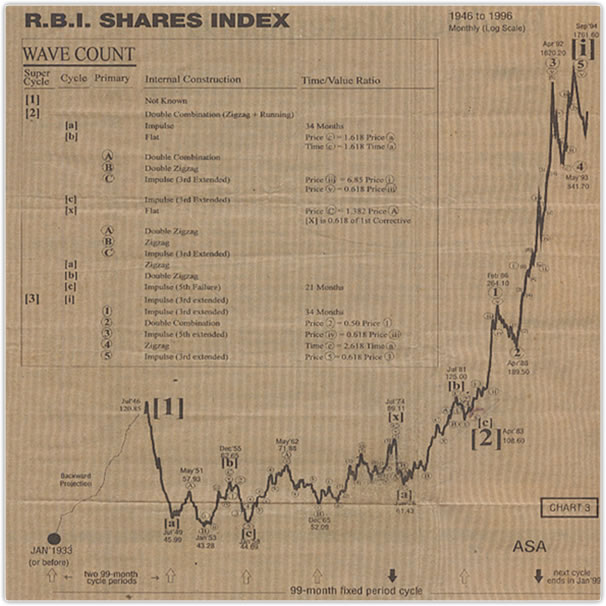

Super-Cycle Degree (Chart 3)

The Super-Cycle degree wave 1 finished in the year 1946 (a year before Independence), and was followed by the corrective wave 2 till 1983 (37 years). Wave 3 commenced in 1983, and the "Cycle" degree (one lower degree) wave-l within it finished in September 1994. From September 1994, we are in the Cycle degree wave-2, which will complete only after 2002

The RBI Shares Index is the oldest index for the Indian stock market, and is constructed by this author from the "Index Numbers for Shares” published in RBI bulletins. The Wave Theory works best on log scale. In absence of such a chart, putting a Super-cycle degree count would have been very difficult.

Cycle degree Wave 2 (Chart 2)

This was projected to be a "Complex Corrective" involving two correctives separated by a large-X wave. The first corrective was a "C Failure Flat" from September 1994 to April 1999, within which the wave-b was an "Expanding Triangle" and wave-c was a “Terminal Impulse with 5th Failure" ending at 3183 in April 1999. Ending at 3183 also gives us the "failure" point (being above 2966, the end of wave-a), as projected

| Why should the Cycle degree wave-2 be a "Complex Corrective"? - Because "Expanding Triangle" pattern is most common only in large "Complex" correctives.

Why should the wave-c, after an Expanding Triangle wave-b, be a "Failure"? - Because an "Expanding Triangle" takes away the power from the next wave which inevitably results into a failure. Remember the "endpoint” of a wave is to be considered for judging a "failure". |

| Terminal ended at 3183 in April 1999 (Chart 4)

The Terminal (which is the wave-c of the first corrective) starting at 4605 in August 1997, showed a clear 3-3-3-3-3 internal construction and an overlap of 1st and 4th, as required for a "Terminal". These five segments are as follows: - C1 was from 4605 to 3261 : Doub1e Combination Within this terminal, C3 was extended (slightly larger than C1) and the C5 was a "failure". |

| “C” of C5 was also a terminal

Within the C5 ("Flat" from 3515 to 3183), the “c” again was a "Terminal with fifth extended" (Expanding Terminal). This was an important observation, because a "Terminal" would signify termination of a larger pattern. This Terminal of 28 days was fully retraced in seven days (exactly 25 per cent time). 99-month Cycle Within the larger Terminal (from 4605 to 3183), the lowest Sensex of 2741 occurred in December 1998, which is very close to the 99-month cycle. (99-month cycle was due in January 1999 as projected on the RBI Shares Index). Terminals result in fast counter-moves It was also noted that the Terminal should get completely retraced within 25 per cent (maximum 50 per cent) of the time of the Terminal. This has also been achieved by Sensex now, by moving beyond 4605 (the starting point of the Terminal) in only 13 per cent time. Originally called as ''Diagonal Triangle" by Elliott, a "Terminal" (named so by Neely) is a 3-33-3-3 Impulse pattern coming as 5th or c-Wave (last segment), wherein the 4th must have entered the area covered by the 2nd (called "overlap”). Since it terminates a larger pattern, the moves out of a Terminal, should be very fast. Large-X-Wave Based on the "mimicking" principle, it was noted that a Large X-wave would open after the first corrective is over. By definition, a "Large-X" would be minimum 1.618 times the first corrective, thus giving us a minimum target of 5545 points for the current X-wave. Its internal construction should alternate with the first corrective (which was a Flat). Therefore, the current "Large-X" should be a "Zigzag" or a "Double Zigzag". X-wave is a "Corrective" and not an Impulse pattern, although it may create new all time highs. What next after Large X? After the ongoing "Large-X" is over, the second corrective would occur, rendering the entire formation from September 1994 onwards as being A-B-C-"X"-A-B-C. 1, therefore, expect some more consolidation, though at higher level, till one more corrective within this Cycle degree wave-2 is over. That will be some time after 2002. If the Cycle degree wave-3 is going to be strong, then this second corrective may come as a "running" corrective. Within this consolidation, however, we should see the Sensex crossing a minimum 5545 (the minimum target for the large-X wave) as explained earlier. |

| Mimicking

It was also shown how the current "Cycle" degree wave-2 has mimicked the pattern of the "Super-'Cycle" degree Wave-2 in the last five years. In fact it was this "Mimicking" principle which enabled this author to forecast the Sensex movements two years ago. To see the "mimicking" principle in action, please compare the pattern between the year 1946 to 1969 on RBI Shares Index, with the pattern on Sense x from September 1994 onwards. This is as far as the earlier forecasts are concerned. These forecasts, however, throw up very interesting possibilities for the future. The Future (Monthly Sensex in Chart 1) Once the Cycle degree wave-2 is over (somewhere after the year 2002), the Cycle degree 3rd of the Super-Cycle degree 3rd would open. This will be the most dynamic phase for the Indian stock market in its entire history. This wave, being the 3rd of the 3rd, should be at least 0.618 Fibonacci ratio applied on "log" scale to the 1st wave. This gives us a target above 45000 points. The time period required to achieve this will, conservatively, be not more than 1.618 Fibonacci ratio to the 1st wave (which was for 12 years), i.e. 19 years counted from the end of the 2nd, thus completing by the year 2025. Cycle degree 4th and 5th (of the Super-Cycle degree 3rd} will follow during the rest of the 21st century. Therefore, one can safely say that the Sensex should cross 45,000 points before the year 2025. (as shown in Chart 1). Since the estimates are only conservative, these projections are virtually guaranteed. We may, in reality, see a higher figure that what has been projected here. (The author is the creator of the technical analysis software ASA. |